PetroStrategies, Inc. PetroStrategies, Inc. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

BP Deepwater Horizon

On April 20, 2010 a massive explosion rocked the BP Deepwater Horizon in the Gulf of Mexico. The explosion and fire caused the death of eleven crewmen. The wrecked rig sank two days later. The Deepwater Horizon was an ultra-deepwater, dynamically positioned, semi-submersible offshore drilling rig. The Deepwater Horizon was built in 2001 in South Korea. Deepwater Horizon is owned by Transocean and was leased to BP plc until September 2013. It was registered in Majuro, Marshall Islands. In September 2009, she drilled the deepest oil well in history at a vertical depth of 35,050 feet and measured depth of 35,055 feet. As the events are currently understood, the drilling crew was completing the well after reaching its target depth and the oil-rich reservoir. During the drilling operation, drilling mud is used to lubricate the drill bit, remove rock cuttings around the bit and send them to the surface, and control the pressure at the bottom of the hole. As part of the completion operation, salt water is pumped down the well to remove the drilling fluids so that production casing can be cemented into place. At this stage in the process, methane hydrates entered the well hole from the reservoir. Methane hydrates are water crystals that surround a methane molecule (CH4). The crystals exist in the form of a semi-frozen slush and are commonly found in deep offshore wells where the low temperatures and high pressures combine to produce them. The slush moved up the drilling pipe and broke seals along the route perhaps causing the gas to escape into the drilling riser. As the gas moved up the pipe/riser the temperature increased and the pressure decreased. The combination of these two states caused the volume to expand. (The ideal gas law says PV = nRT so as temperature (T) increases and pressure (P) decreases, the volume (V) has to increase n and R are constant.) When the gas reached the surface it escaped around the drilling table and flowed into the rig control room where the electrical operating and monitoring devices produced a spark that caused the explosion. Mike Williams, the chief electronics technician in charge of the rig's computers and electrical systems and one of the last people to leave the Deepwater Horizon, presented his account of events that led up to the disaster on Sixty Minutes (May 16, 2010). Williams said the destruction of the Deepwater Horizon had been building for weeks in a series of mishaps. The night of the disaster, he was in his workshop when he heard the rig's engines suddenly run wild. That was the moment that explosive gas was shooting across the decks, being sucked into the engines that powered the rig's generators. Williams said there was an accident on the rig that has not been reported before. He says, four weeks before the explosion, the rig's blowout preventer (BOP) was damaged. A key component is a rubber gasket at the top called an "annular," which can close tightly around the drill pipe. Williams said that during a test, they closed the gasket. But while it was shut tight, a crewman on deck accidentally nudged a joystick, applying hundreds of thousands of pounds of force, and moving 15 feet of drill pipe through the closed blowout preventer. Later, a man monitoring drilling fluid rising to the top found chunks of rubber in the drilling fluid. A supervisor dismissed the fragments as "... no big deal." There was another problem with the blowout preventer. The BOP is operated from the surface by wires connected to two control pods with one serving as a back-up. Williams said that one pod lost some of its function weeks before. Transocean said the BOP was tested by remote control after these incidents and passed. Deepwater Horizon's work was nearly done and was ready to seal the well closed. Williams said that during a safety meeting, the manager for the rig owner, Transocean, was explaining how they were going to close the well when the manager from BP changed the process. "I'm hearing hissing. Engines are over-revving. And then all of a sudden, all the lights in my shop just started getting brighter and brighter and brighter. And I knew then something bad was getting ready to happen," said Williams.

(Source: "Blowout: The Deepwater Horizon Disaster," CBS Sixty Minutes, May 16, 2010) The House Energy and Commerce Committee released dozens of BP internal documents that outline several problems on the deep-sea rig in the days and weeks before the April 20th explosion. Investigators found that BP was badly behind schedule on the project and losing hundreds of thousands of dollars with each passing day and responded by cutting corners in the well design, cementing and drilling mud efforts and the installation of key safety devices. "Time after time, it appears that BP made decisions that increased the risk of a blowout to save the company time or expense. If this is what happened, BP's carelessness and complacency have inflicted a heavy toll on the gulf, its inhabitants and the workers on the rig," said Democratic Reps. Henry Waxman and Bart Stupak. Congressional investigators identified several mistakes by BP in the weeks leading up to the disaster as it fell way behind on drilling the well. BP started drilling in October, but the rig being used was damaged by Hurricane Ida in early November. The company brought in a new rig, the Deepwater Horizon, and resumed drilling Feb. 6th. The rig was 43 days late for its next drilling location by the time it exploded April 20th, costing BP at least $500,000 each day it was overdue. As BP hurried to complete the well, engineers took several time-saving measures, according to congressional investigators. In the design of the well, the company apparently chose a riskier option among two possibilities to provide a barrier to the flow of gas in space surrounding steel tubes in the well, documents and internal e-mails show. The decision saved BP $7 million to $10 million; the original cost estimate for the well was about $96 million. In an e-mail, BP engineer Brian Morel told a fellow employee that the company is likely to make last-minute changes in the well. "We could be running it in 2-3 days, so need a relative quick response. Sorry for the late notice, this has been nightmare well which has everyone all over the place," Morel wrote. The e-mail chain culminated with the following message by another worker: "This has been a crazy well for sure." BP also apparently rejected advice of a subcontractor, Halliburton Inc., in preparing for a cementing job to close up the well. BP rejected Halliburton's recommendation to use 21 "centralizers" to make sure the casing ran down the center of the well bore. Instead, BP used six centralizers. In an e-mail April 16, a BP official involved in the decision explained: "It will take 10 hours to install them. I do not like this." Later that day, another official recognized the risks of proceeding with insufficient centralizers but commented: "Who cares, it's done, end of story, will probably be fine." The lawmakers also said BP also decided against a nine- to 12-hour procedure known as a "cement bond log" that would have tested the integrity of the cement. A team from Schlumberger, an oil services firm, was on board the rig, but BP sent the team home on a regularly scheduled helicopter flight the morning of April 20. Less than 12 hours later, the rig exploded. BP also failed to fully circulate drilling mud, a 12-hour procedure that could have helped detect gas pockets that later shot up the well and exploded on the drilling rig. The letter from Waxman and Stupak noted at least five questionable decisions BP made before the explosion and was supplemented by 61 footnotes and dozens of documents. "The common feature of these five decisions is that they posed a trade-off between cost and well safety," said Waxman and Stupak. Waxman, D-CA, chairs the energy panel, and Stupak, D-MI, leads a subcommittee on oversight and investigations. (Source: "Gulf Oil Spill," Mathew Daly and Ray Henry, Associated Press, The Dallas Morning News, June 15, 2010) 4Go to the Topic Listing 4Go to the Topic Listing

4Go to the Topic Listing Efforts to Stop Leak

BP Oil Spill on June 25, 2010 (Source: Oil spill, Wikipedia) BP is attempting to contain the leak using a variety of techniques:

Scientists and engineers are questioning the current estimates of the size of oil estimated to be 5,000 barrels per day. Some believe the value to be four or five times larger or up to 25,000 barrels per day. Estimates range as high as 50,000 barrels per day (Source: ABC Good Morning America, May 14, 2010) Scientists have reported finding enormous oil plumes in the deep waters of the Gulf of Mexico. One is estimated to be 10 miles long, three miles wide and 300 feet deep. The plumes lead scientists to increase the spill to be from 25,000 barrels per day to as high as 80,000 barrels per day. They say the use of chemical dispersants, that BP has injected into the oil at the well may have broken up the oil into droplets too small to rise rapidly to the surface. (Source: "Tube plan fails; 2nd try planned," Dallas Morning News, May 16, 2010, p. 3A.) BP said Monday it was siphoning more than one-fifth of the oil that has been spewing into the Gulf for almost a month. BP said Monday on NBC's "Today" that a mile-long tube was funneling a little more than 1,000 barrels a day from a blown well into a tanker ship. BP engineers remotely guiding robot submersibles had worked since Friday to place the tube into a 21-inch pipe nearly a mile below the sea. After several setbacks, it was working, though BP acknowledged there was still work to be done to get the device working at full capacity. (Source: "Worry That Gulf Oil Spreading Into Major Current," ABC News, May 17, 2010) 4Go to the Topic Listing Natural Gas HydratesA gas hydrate is a crystalline solid; its building blocks consist of a gas molecule surrounded by a cage of water molecules. Thus it is similar to ice, except that the crystalline structure is stabilized by the guest gas molecule within the cage of water molecules.

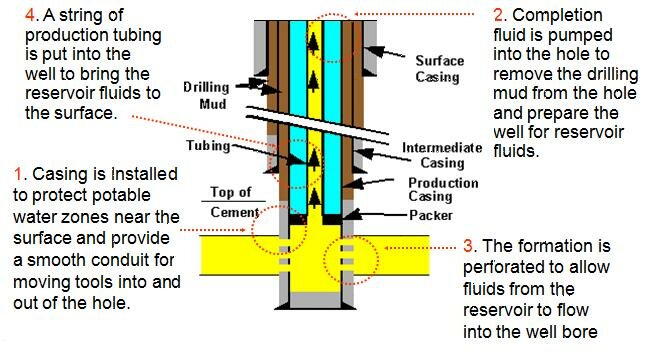

After a well has been drilled, it must be completed before oil and gas production can begin. The first step in this process is installing casing pipe in the well. Oil and gas wells usually require four concentric strings of pipe: conductor pipe, surface casing, intermediate casing, and production casing. The production casing or oil string is the final casing for most wells. The production casing completely seals off the producing formation from water aquifers. The production casing runs to the bottom of the hole or stops just above the production zone. Usually, the casing runs to the bottom of the hole. In this situation the casing and cement seal off the reservoir and prevent fluids from leaving. In this case the casing must be perforated to allow liquids to flow into the well. This is a perforated completion. Most wells are completed by using a perforated completion. Perforating is the process of piercing the casing wall and the cement behind it to provide openings through which formation fluids may enter the wellbore.

The blowout preventer (BOP) is a large valve at the top of a well that may be closed if the drilling crew loses control of formation fluids. By closing this valve (usually operated remotely via hydraulic actuators), the drilling crew usually regains control of the reservoir, and procedures can then be initiated to increase the mud density until it is possible to open the BOP and retain pressure control of the formation. BOPs come in a variety of styles, sizes and pressure ratings. Some can effectively close over an open wellbore, some are designed to seal around tubular components in the well (drillpipe, casing or tubing) and others are fitted with hardened steel shearing surfaces that can actually cut through drillpipe. (Source: Schlumberger Oilfield Glossary)

On Wednesday May 12, 2010, a House energy panel found that the blowout preventer that failed to stop a the oil spill had a dead battery in its control pod, leaks in its hydraulic system, a "useless" test version of a key component and a cutting tool that wasn't sharp enough to shear through steel joints in the well pipe and stop the flow. The well must now be filled with cement to permanently close well. (Source: "Blowout preventer was in bad repair," The Dallas Morning News, May 13, 2010, p. 1A.)

Click on picture to enlarge (Source: "Well may be filled with cement this week," The Dallas Morning News, August 1, 2010) BP announced on August 4, 2010 that more than 96,000 gallons of mud forced down the well in the "static kill" operation had finally plugged the well. However, concerns linger as to ongoing cleanup efforts and the long-term affect of the spill on the ecosystem. (Source: "Well is plugged, but doubts about dissipating oil haven't subsided," The Dallas Morning News, August 5, 2010) BP finished pumping fresh cement into the wellbore on August 5, 2010. The Coast Guard said that this was the end and retired Coast Guard Admiral Thad Allen said "it will virtually assure us that there will be no chance of oil leaking into the environment." However, on a disturbing note, BP has refused to say whether it will use the two relief wells to plug the well for good. The company has said that it might not need to use the relief wells to plug the leak and might instead use one of them as a production well. [Given BP's record this should start sounding warning bells-Editorial Comment] (Source: "BP finishes bolstering mud plug with cement," The Dallas Morning News, August 6, 2010)

Parties Involved in the Explosion and Spill An April 30th Merrill Lynch report found that five companies connected to the disaster, BP, Transocean, Anadarko Petroleum, Halliburton and Cameron International, had lost a total of $21 billion in market capitalization since the explosion. It noted that Halliburton, which had lost $1.5 billion, "generally does not take environmental risk" and includes a limited liability clause in its contracts, and that Cameron's loss of $1.8 billion in market value was out of proportion to its involvement as manufacturer of the blowout preventer, as "most manufacturers are not responsible for consequential damages." Currently, United States federal law limits BP's liability for non cleanup costs to $75 million. Players

Notes: 1 Discovery date of spill from area refineries that may date from 1840

Where the Oil Went1 Best estimate of what happened to the oil spilled into the Gulf of Mexico after the Deepwater Horizon exploded based on a total spill of 206 million gallons

1 U.S. National Incident Command 2 On or just below the surface as light sheen or tar balls; washed ashore; buried in sand and sediments (Source: "Well is plugged, but doubts about dissipating oil haven't subsided," The Dallas Morning News, August 5, 2010)

The federal government alleges that safety and operating regulations were violated in the period leading up the Deepwater Horizon explosion. It says the defendants failed to keep the well under control and failed to use the best available and safest drilling technology to monitor the well's conditions. It also says they failed to maintain surveillance and failed to maintain the equipment and material necessary to protect workers, natural resources and the environment. Under the Clean Water Act alone, BP faces fines of up to $1,100 for each barrel of oil spilled. If BP were found to have committed gross negligence or willful misconduct, the fine could increase to $4,300 a barrel. Based on the government's estimate of 206 million gallons released, BP could face fines of from $5.4 billion to $21.1 billion. The other defendants in the case are the the other working interest partners: Anadarko Exploration & Production, Anadarko Petroleum and MOEX Offshore 2007. Other defendants are Triton Asset Leasing, Transocean Holdings, Transocean Offshore Deepwater Drilling, Transocean Deepwater, and Transocean's insurer, QBE Underwriting/Lloyd's Syndicate 1036. (Source: "Government sues BP, other firms," The Dallas Morning News, December 16, 2010, p. 2A.

Gulf Spill Report's Key Findings

(Source: "Criminal charges likely to lead to billions more in fines," The Dallas Morning News, January 7, 2011)

BP has reached a settlement with the Plaintiffs' Steering Committee (PSC), subject to final written agreement, to resolve the substantial majority of legitimate economic loss and medical claims stemming from the Deepwater Horizon accident and oil spill. The PSC acts on behalf of individual and business plaintiffs in the Multi-District Litigation proceedings pending in New Orleans (MDL 2179). BP estimates that the cost of the proposed settlement, expected to be paid from the $20 billion Trust, would be approximately $7.8 billion. This includes a BP commitment of $2.3 billion to help resolve economic loss claims related to the Gulf seafood industry. Prior to the proposed settlement, BP had spent more than $22 billion toward meeting its commitments in the Gulf. BP has paid out more than $8.1 billion to individuals, businesses and government entities. In addition, BP has spent approximately $14 billion on operational response. The proposed settlement does not include claims against BP made by the United States Department of Justice or other federal agencies (including under the Clean Water Act and for Natural Resource Damages under the Oil Pollution Act) or by the states and local governments. The proposed settlement also excludes certain other claims against BP, such as securities and shareholder claims pending in MDL 2185, and claims based solely on the deepwater drilling moratorium and/or the related permitting process. The proposed settlement also provides that, to the extent permitted by law, BP will assign to the PSC certain of its claims, rights and recoveries against Transocean and Halliburton for damages not recoverable from BP. (Source: "BP Deepwater Horizon settlement announced," PennEnergy, March 5, 2012)

Adding Up the Costs

Resources used, April-August 2010

Wildlife and plants destroyed

Costs and damages paid

(Source: "April 20, 2010 - The Gulf Oil Spill One Year Later," The Dallas Morning News, April 20, 2011, p. 7A)

Latest NewsEx-Halliburton manager pleads guilty to destroying Deepwater Horizon evidence A former Halliburton manager has plead guilty in U.S. District Court to destroying evidence in the aftermath of the 2010 Deepwater Horizon disaster in the Gulf of Mexico. Anthony Badalamenti, 62, will face the possibility of 1 year of prison time and a fine of $100,000 when he is sentenced January 21st. Prosecutors allege two employees received instruction from Badalamenti to delete the results of simulations conducted on the Macondo well in the days following the explosion and spill. (Source: "Ex-Halliburton manager pleads guilty to destroying Deepwater Horizon evidence," PennEnergy, October 16, 2013.) Transocean pleads guilty for criminal conduct leading to Deepwater Horizon disaster Transocean Deepwater Inc. pleaded guilty today to a violation of the Clean Water Act (CWA) for its illegal conduct leading to the 2010 Deepwater Horizon disaster, and was sentenced to pay $400 million in criminal fines and penalties, Attorney General Holder announced today. In total, the amount of fines and other criminal penalties imposed on Transocean are the second-largest environmental crime recovery in U.S. history � following the historic $4 billion criminal sentence imposed on BP Exploration and Production Inc. in connection with the same disaster. (Source: "Transocean pleads guilty for criminal conduct leading to Deepwater Horizon disaster," PennEnergy, February 14, 2013.) Transocean settles federal claims arising from Macondo incident Transocean Ltd.�s subsidiary Transocean Deepwater Inc. has agreed with the U.S. Department of Justice to resolve certain outstanding civil and potential criminal claims arising from the accident in the Gulf of Mexico involving the Deepwater Horizon drilling rig. Transocean has agreed to plead guilty to one misdemeanor violation of the Clean Water Act for negligent discharge of oil into the Gulf of Mexico, and pay $1.4 billion in civil and criminal fines, recoveries and penalties, excluding interest. For its part, the Department of Justice will conclude its criminal investigation of Transocean and settle its claims for civil penalties relating to the spill. Under the civil settlement, the Transocean defendants must observe various court-enforceable strictures in its drilling operations. Examples of these requirements include certifications of maintenance and repair of BOPs before each new drilling job, consideration of process safety risks, and personnel training related to oil spills and responses to other emergencies. These measures apply to all rigs operated or owned by the Transocean defendants in all U.S. waters and will be in place for at least five years. Anadarko and BP settled claims between the two companies late this past year. (Source: "Transocean settles federal claims arising from Macondo incident," PennEnergy, January 4, 2013.) New Orleans judge gives final approval to BP Macondo settlement US District Judge Carl Barbier in New Orleans gave final approval to BP PLC�s settlement in a class action lawsuit with a number of businesses and individuals regarding the April 2010 oil spill in the Gulf of Mexico from the deepwater Macondo well off Louisiana. BP estimates it will pay $7.8 billion to resolve economic and medical claims from more than 100,000 businesses and individuals although the settlement has no cap. BP could wind up paying more or less than that amount. Barbier released a final 125-page ruling late Dec. 21 after giving his preliminary approval earlier in the year. He noted that he found none of the objections filed "have shown the settlement to be anything other than fair, reasonable, and adequate." BP responded that it considers the settlements to be in the best interests of many. A BP spokesman said, "We believe the settlement, which avoids years of lengthy litigation, is good for the people, businesses and communities of the gulf and is in the best interests of BP�s stakeholders." Barbier noted much litigation remains pending, including environmental damages with the US government under the Clean Water Act. (Source: "New Orleans judge gives final approval to BP Macondo settlement," PennEnergy, December 26, 2012.) BP to pay record $4.5 billion fine for Deepwater Horizon disaster BP has been levied a record-setting $4.5 billion fine from the Justice Department and the Securities & Exchange Commission for the 2010 Deepwater Horizon disaster in the Gulf of Mexico. (Source: "BP to pay record $4.5 billion fine for Deepwater Horizon disaster," PennEnergy, November 16, 2012.)

References

Copyright 2010 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||